Maximizing Growth: Learn How to Master the SaaS Profit and Loss Statement

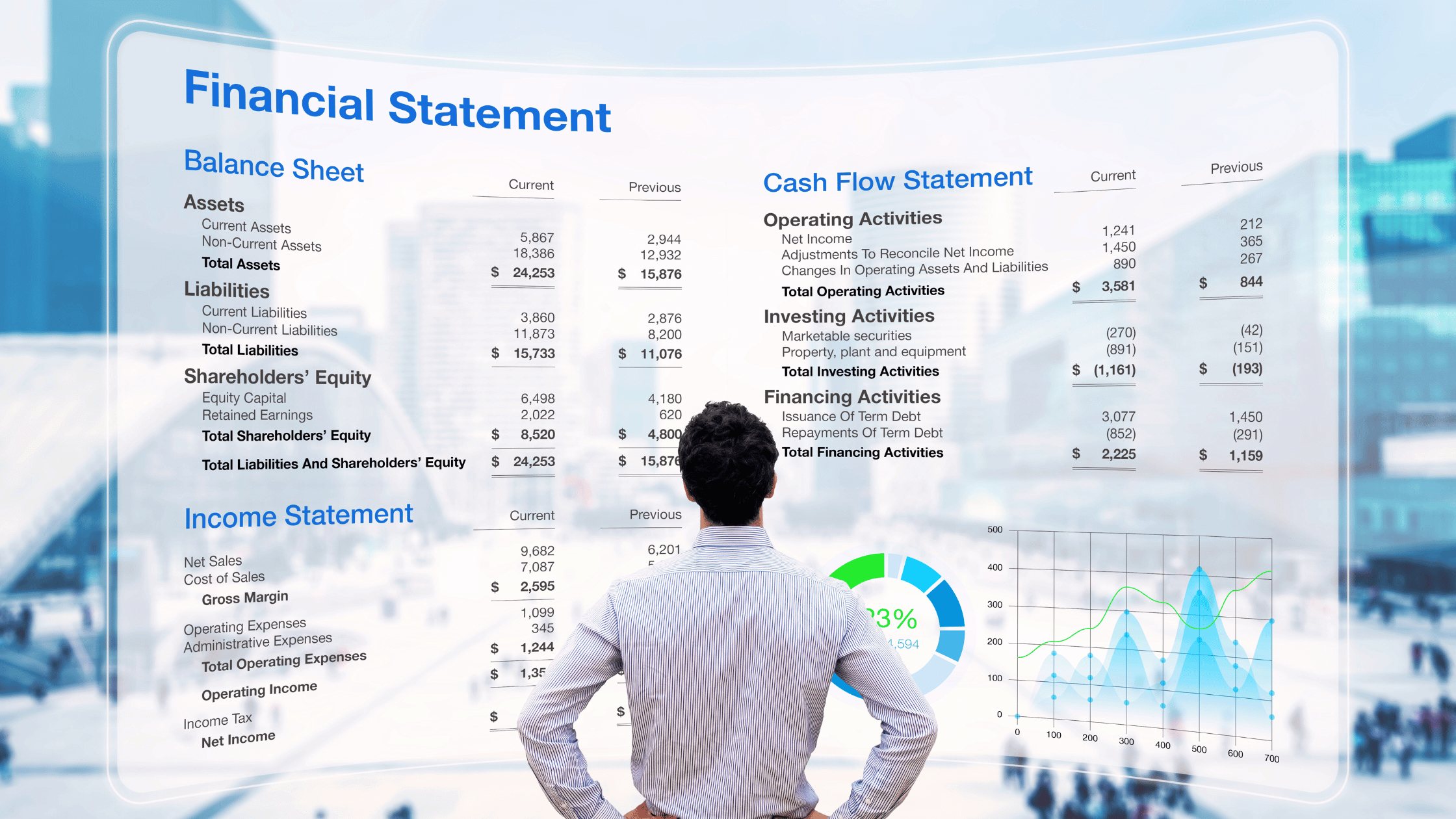

SaaS has emerged as a prominent business model, offering unparalleled opportunities for growth and profitability. However, to unlock the full potential of a SaaS venture, entrepreneurs and executives must understand and master the SaaS Profit and Loss (P&L) statement. There are many wrong ways to create P&L statements in tools like QuickBooks, Xero, Intacct, or Netsuite. SaaS companies should have their P&L statement structured the right way. This allows investors to easily analyze performance and executive teams to benchmark themselves with others in the industry. Understanding the SaaS P&L Statement The SaaS Profit and Loss statement is a financial [...]

Both SaaS Finance and SaaS Accounting are Essential

In the dynamic realm of SaaS, finance and accounting emerge as integral components, each playing a distinct yet interconnected role. Let’s explore how CEOs can build an effective finance and accounting team and why having a SaaS-specialized fractional CFO is a strategic imperative. SaaS Finance and Accounting: Interconnected Functions SaaS functions much like a living organism, relying on data, metrics, and financial precision. Finance acts as the visionary, projecting growth, managing budgets, and aligning financial strategies with business objectives. Accounting, on the other hand, serves as a meticulous steward, recording transactions and ensuring compliance. Together, it’s a symbiotic relationship—each [...]

Boost Your SaaS Bottom Line: The Ultimate Cost of Revenue Breakdown

Understanding the nuances of SaaS financial metrics is crucial for sustainable growth. Let’s shed some light on a critical aspect of this—the Cost of Revenue (also called Cost of Goods Sold)—the complexities of it, the key components, and look at insights that SaaS founders need to know when they are looking to optimize their financial strategy. Deciphering the Cost of Revenue Puzzle For SaaS companies, understanding the components of the Cost of Revenue is crucial, as it sets the foundation for financial sustainability, company valuations, and cash flow. Even though there is no official GAAP determination of Cost of [...]

Transforming Financial Health: A Case Study in the Clinical Research Industry

In today’s fast-paced world of commerce, cash has always been king. Without a clear understanding of their cash flow, companies risk financial instability and potential failure. In this case study, we're sharing how our engagement with an organization in the clinical research space transformed their financial health. Our client, the organization, operates in the clinical research industry—a sector that demands precision, dedication, and unwavering commitment to advancing medical knowledge. With annual revenue between $5-10 million and a dedicated team of 20 employees, this organization's mission is to promote knowledge and skills among clinical researchers, fostering growth and excellence within the [...]

Compare Your SaaS Profits: Actual vs. Budgeted – What’s the Difference?

The success of any business relies on the ability to effectively manage its financial resources. In the case of Software as a Service (SaaS) companies, tracking actual profit and loss versus the budget is the foundation of cash forecasting. Let’s take a deeper look at the differences between actual profit and loss and budget in SaaS companies, exploring the factors that contribute to accurate financial forecasting. Defining Actual Profit and Loss and Budget Actual profit and loss (P&L) refers to the financial statement that tracks the revenue, expenses, and net income or loss of a company over a specific period. [...]

3 Mistakes New SaaS Companies Make that Block Growth

You receive amazing feedback on your business plan, raised your first round of funding, and launched your product. But wait … why isn’t your business growing at the rate you expected? This can be discouraging, and it’s a common trap we see. We call it the “field of dreams trap.”

Successful Budgeting for SaaS Startups: 5 Key Best Practices

Following these budgeting strategies early on will help your SaaS startup with cashflow, forecasting and avoid wasted time that should be spent building your business.

SaaS Topics

Most Recent

- From Startup to Success: Anthony Nitsos Advises on Financial Strategy in The Brandon White Show Feature

- From Ambiguity to Clarity: A CEO’s Struggle with Financial Clarity

- Maximizing Growth: Learn How to Master the SaaS Profit and Loss Statement

- Decoding SaaS Metrics for Unparalleled Growth

- Both SaaS Finance and SaaS Accounting are Essential