Hire a SaaS Financial Consultant in Michigan to Avoid These Common Pitfalls

Hire a SaaS Financial Consultant to Avoid These Common Pitfalls

Hiring a Michigan SaaS Financial Consultant can ensure your finance and stakeholder ecosystem is set up for success at the early stage of your business.

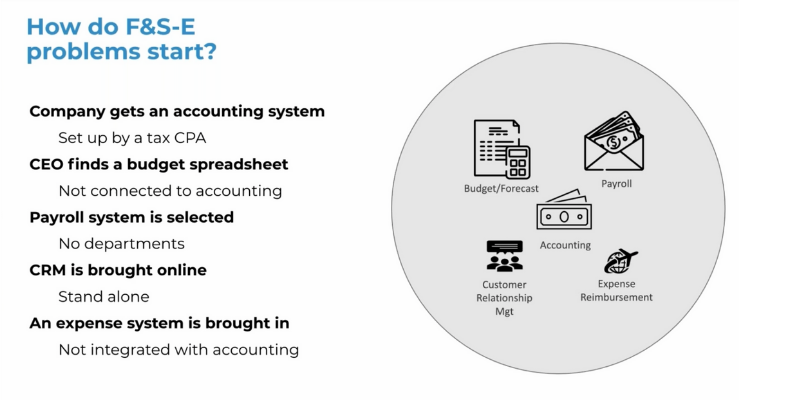

If you missed our article explaining the benefits of a F&S Ecosystem for your SaaS business be sure to check it out. But today we will be covering what problems can occur when you don’t set up your F&S Ecosystem correctly from the start.

Accounting System Lacks SaaS Metrics

All businesses start off with an accounting system. One of the first things you need is to keep track of is your expenses, even before you have revenue. So sooner or later you will need QuickBooks or some kind of accounting software. And this is almost always set up by your CPA.

I love tax CPAs just as much as anybody, but the problem with CPAs is they are a specialist in their field and they come at the world with a particular view, and they do that when they set up your accounting system.

For example, I just engaged with a new customer and reviewed their accounting system. This company is already pretty sizable. They have more than a couple of dozen employees and all of their payroll’s in one line item on the P&L . This is extremely problematic because no one is breaking key items into the correct departments.

If your accounting system is set up this way, you can’t get important SaaS metrics, such as cost to acquire customer because you don’t have marketing and sales information that’s easily extractable. And even more important, you can’t get your gross margin. This is a huge metric when it comes to your SaaS business. If you don’t know what that gross margin looks like you’re going to have trouble with valuations and investors. One of the first things investors are going to want is to make sure that you’re keeping that SaaS gross margin really fat and happy.

A SaaS financial consultant can detect these accounting bottlenecks early and set up a standard B2B SaaS cost structure financial statement that provides critical data and SaaS Metrics.

Isolated Budgeting Spreadsheet

The next misstep happens when a CEO or founder finds a budget spreadsheet from a friend or somewhere on the web. The problem with those spreadsheets is they’re not really connected to your accounting system. So you’ll be projecting something in your budget and then sooner or later, you have to translate that into what the accounting system is doing.

Here’s a prime example. You’re probably budgeting your payroll based on departments and the head counts within the departments. But if your accounting system only has one great big line item, how can you ever possibly know what your actual versus budget is or whether you’re actually hitting the performance marks in a particular department that you need? So having a budget spreadsheet that’s not connected to your accounting system is a real big miss and can create a lot of aggravation and wasted time.

Payroll with No Departments

Sooner or later, of course, you’re going to have employees and select a payroll system. You might go out and grab Gusto, Bamboo, ADP or whatever it happens to be. But what happens is nobody really sets up any departments in there. Once again, this comes back to that accounting interface. You’re going to get your payroll information, but you’re not going to know who is in what department or what the costs are by department. So you’re going to be missing really critical business management information by not having your P&L broken up correctly.

CRM is Missing Accounting Data

At some point you’re going to get a Customer Relationship Management CRM program. It could be Salesforce, Nutshell, or HubSpot and usually the sales team or the marketing team sets that up. But sales and marketing people are not thinking about accounting and finance. The accounting and finance folks are the ones that have to take those orders and turn them into invoices.

If signed contracts aren’t integrated fully into the ecosystem you’re going to have that fire drill when you try to find those customer contracts. Or accounting’s going to be asking you and peppering you with questions. “So what’s the subscription start date? How much was that? What’s the expansion on that?” And then your sales team is bogged down and slowed down by answering questions that has nothing to do with growing the top line.

So this is how the problems start. And then sooner or later you end up with a pile of technology or what we like to call, The Tech Pile.

The Aftermath: The Tech Pile

You’ve got apps that are siloed, so they’re not talking to each other. You can run into this, especially as your business gets larger. For example, someone buys an online tool only to find out you already have two of them in-house. So you’ve just wasted money on a third one. This is what happens when systems don’t talk to each other. You have process holes. Or you have conflicting numbers. You have one system that says your ARR is this and another one that says that. Or even worse, accounting says, “This is how much we invoiced in the period. And Salesforce has a different number.” So those kinds of things basically just continue to increase that aggravation and wasted time in the back office. It can block due diligence or bring it to a halt while suddenly everybody’s scrambling to find a document or record that’s needed. So in the end, this tech pile and the way it grows ends up in just a tremendous amount of wasted time and money.

How Fractional CFO Services Can Fix the Tech Pile

Anthony Nitsos, Founder and Fractional CFO

Anthony Nitsos elevates your financial strategy to meet challenges and drive your company value. Working with pre-seed to Series B stage SaaS startups, he ensures that founders have reliable metrics and a solid understanding of the true economics of their business to maximize valuation. He optimizes financial operations, sales operations, human resources operations, and risk management systems. He’s worked with various startups, including two unicorn exits.